I can be a curmudgeon. Two decades as a marketing technology industry analyst has turned me into that guy who inspirational conference keynoters warn you about — the one who often replies, “been there, tried that.” Training and hard experience has taught me to see patterns, and in a martech world emphasizing new-and-shiny, patterns often do recur.

A story

So let me tell you a story. It’s about the birth and growth of a critical piece of marketing technology, innovated by some upstart vendors exploiting new, modern frameworks.

The story goes like this. New technology emerged for non-technical marketers to perform agile work heretofore consigned to developers, thus eliminating frustrating bottlenecks. The new platforms were pitched as “liberating” technology and quickly became an essential piece of enterprise martech stacks. Those new vendors grew quickly amidst disdain by the leading major software players, who finally came to realize they needed to enter this market. But it was too late: dozens of upstarts held a prohibitive lead, and the major vendors proved too hidebound to their existing, outdated architectures. So a highly fragmented marketplace endured, with rapid innovation and lower prices for all. This made enterprise marketers very happy.

That story is about the Web CMS marketplace, circa 2001.

It was 2001 when I founded “CMS Watch,” now Real Story Group, to analyze, track, and evaluate the dozens of Web Content and Experience Management (WCM) players coming onto the market. Now in 2021 I see a nearly identical story arising with Customer Data Platforms (CDPs).

Of course one must avoid overplaying historical parallels, but the similarities between the rise of WCM and the rise of CDPs are uncanny. More importantly, I think this story can teach you, the enterprise martech leader, some important lessons.

Evolution of the WCM marketplace

Upstarts

The WCM market was founded and nurtured by dozens of upstart vendors and (mostly commercial) open source projects. The sheer diversity of approaches astounded me at the time, but nearly all the vendors exploited the new paradigms possible through thin clients, database-driven dynamism, and new templating frameworks. The need for website self-management was so ubiquitous — how did we possibly manage without a CMS? — that the rising tide of demand lifted nearly all vendor boats.

No consolidation

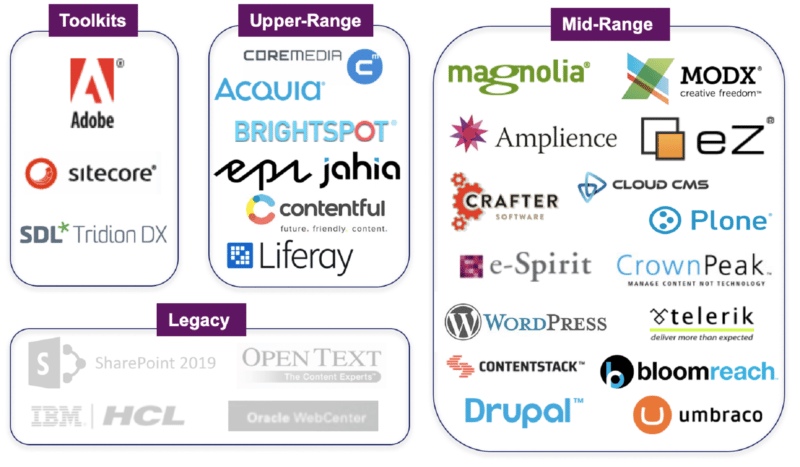

When Microsoft acquired WCM vendor NCompass late in 2001, traditional analyst firms intoned “marketplace commoditization” and predicted looming consolidation of upstart vendors. Well, that didn’t happen. Microsoft abandoned NCompass (as big vendors are wont to do…), while IBM, SAP, Oracle, EMC, and others largely failed in the market, even after some acquisitions. The WCM marketplace did see some M&A activity, but it turns out these are not easy platforms to combine or consolidate, so enterprise customers today can still choose from among at least two-dozen plausible suppliers.

Rapid innovation with eternal trade-offs

This diversity of players led to consistently rapid innovation, along with generally falling license prices over the years (albeit ticking up some with the transition to PaaS subscription models).

Grappling with core business and technical trade-offs has led to cyclical answers to some difficult questions in the WCM world. Do we want to manage content or experiences? Where is workflow best situated? Do we curate content and experiences from the top down or bottom up? Is our WCM platform the center of our digital content universe or just a single channel? I’ve learned over two decades that there’s no single universal answer to any of those questions, but there is a vendor out there that can provide a specific solution depending on how you answer them.

Lessons for CDP buyers

Independent vendor dominance

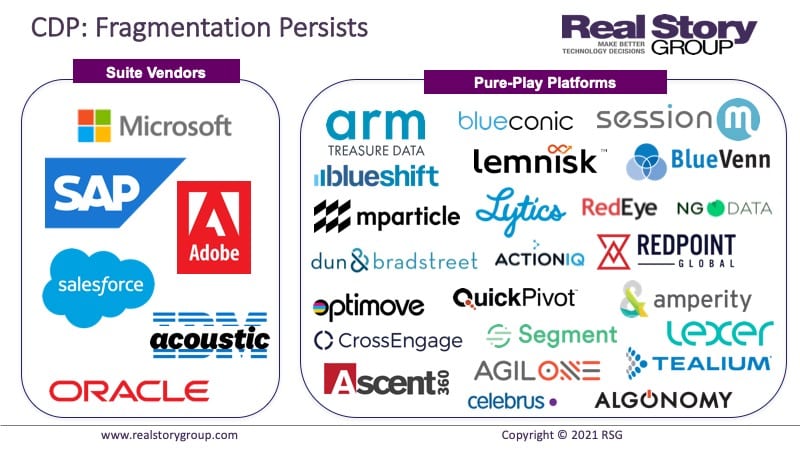

Over the next five years, you’re likely to see most energy in the CDP space continue to emanate from independent vendors. They have a multi-year lead on the majors like Adobe, Microsoft, Oracle, and Salesforce. Independent vendor solutions can more easily fit into diverse stacks, while the larger vendors have proven reluctant to extract themselves from aging investments in their legacy engagement-tier platforms. Their CDP offerings tend toward parochial as a result, and they’ve largely retreated into relationship-oriented CDP sales strategies — or unsubtle bullying — rather than proving out technical and business fit.

Unlikely to consolidate

As with WCM platforms, you cannot readily merge two different CDP solutions. You may see some roll-up attempts, where a single vendor acquires multiple solutions to address different market needs (this rarely ends well). You may see technology aggregators acquire a stalling CDP vendor to milk the ever-beloved maintenance and hosting revenues (not great, but not catastrophic for you the licensee). You will see some venture-fueled CDP players get sold to private equity concerns as a transition from a growth to an earnings play (again: not necessarily bad). If the WCM market offers any parallel, you will not see many CDP vendors disappear outright.

Scope as major differentiator

As with the early stages of the WCM market, CDP vendors appear to be differentiating primarily on scope, and secondarily on cost/complexity. Over time, I’d expect the latter dimension to become more important as enterprise capabilities shake out and the market elongates as it matures. In the near term, though, CDP vendors are increasingly distinguishable by scope:

- Vertical depth in terms of the backwards-facing enterprise data management functions they may (or may not) subsume, and forward-facing engagement and orchestration services they may (or may not) provide; and

- Horizontal breadth in terms of the number of enterprise customer experience use cases they address beyond simply the marketing department

Note that expansive depth and breadth in a CDP may not prove the right fit for your architecture and definitely comes with heavier resource burdens. Also, the lines get fuzzy here. A big part of RSG’s advice to CDP buyers in recent quarters has centered around the finer details of what services reside where in your larger stack. (This recorded briefing shares more insights.)

What you should do

As always, perform viability diligence on any vendors you consider. An independent CDP vendor may employ only 100-200 staffers, so they may be smaller than some of your other martech suppliers. But don’t dismiss that out of hand; the lesson from the WCM market is that smaller vendors can prove more agile and often more enduring.

As the CDP market separates into complexity tiers as it matures, take care not to overbuy here. You may become tempted to select a jack-of-all-trades CDP, but it could prove less agile and more resource-intensive, therefore slowing you down at just the wrong time.

Regardless of vendor, don’t underestimate the services side of a CDP. Many CDP initiatives simply never end. The demands for new data inputs and additional activation channels typically don’t let up. You may need outside help on a consistent basis, particularly with respect to data and event integration. Consider carefully whether the vendor’s own services arm offers the best long-term fit here. The WCM story has been replete with systems integrators playing lead roles. Today on the CDP side, your integrator casting calls will yield thinner implementation talent, but that shouldn’t stop you from trying.

In other words, this curmudgeon is telling you to take some reasonable risks. Why? Because I believe that accessible customer data is essential to the future of your martech stack. Sometimes history can inspire, too.

Real Story on MarTech is presented through a partnership between MarTech and Real Story Group, a vendor-agnostic research and advisory organization that helps organizations make purchasing decisions on marketing technology applications and digital workplace tools.

The post The Real Story on MarTech: History Lessons for CDP Buyers appeared first on MarTech.

0 Comments