When it comes to ad targeting and attribution, Connected TV (CTV) beats traditional TV in every way. From an advertiser perspective, however, the challenge has been one of scale. That now appears to be changing rapidly.

CTV, including OTT (over the top streaming), has been growing steadily for years. But COVID-19 has accelerated everything significantly.

Ready for its closeup. Simpli.fi CEO Frost Prioleau points to his own platform as evidence of the industry’s growth. “We’ve run over 20,000 CTV campaigns for more than 5,900 unique advertisers so far in 2020.” That’s 43% year over year growth in the number of campaigns and a 17% increase in advertisers.

“They come for the targeting and stay for the attribution,” he observes. Advertisers, especially brands, like CTV because it offers the potential visual and emotional impact of television with the measurability of digital media.

Precise targeting and attribution. Prioleau touts CTV’s ability to target and segment addressable audiences using household demographic and economic data, as well as location-based behavioral and intent data. The targeting can be general or precise and based on actual behavior. Campaigns can be tracked online or off, including website traffic, e-commerce conversions and physical store visits.

Like all precision targeting, it might be concerning to consumers, but it’s pretty compelling if you’re a marketer. (Prioleau says that consumer privacy is protected on the platform.)

Prioleau further explains advertisers can also target by device type and screen size: large monitors (TVs), PCs and mobile devices. Marketers can exclude screens and device types as well. He told me that traditional TV advertisers tend to “favor the big screen,” while “digital advertisers want smaller screens.”

Subscription growth and fatigue. According to a survey by consultancy Deloitte, consumers increased the number of entertainment and video OTT subscription services they pay for during COVID-19. Roughly 80% of U.S. consumers reported having at least one video subscription, compared with 73% before the coronavirus hit.

But the CTV/OTT streaming market is different and more volatile than cable TV. There are higher and more frequent rates of subscriber churn as consumers experience “subscription fatigue.” That has increased as more studios and networks have launched proprietary streaming services.

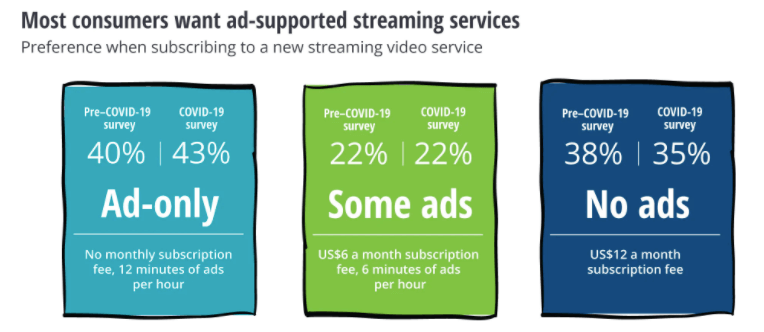

For some people, the answer to subscription fatigue is ad-subsidized content. Deloitte found that CTV users showed different levels of interest in and tolerance for ads, though a majority were interested.

A little over a third (35%) of the audience, especially younger users, didn’t want any ads. Older viewers (Baby Boomers and older) preferred an ad-only model to a premium ad-free subscriptions. “However, all consumers have an ad tolerance of between seven and 14 minutes per hour. After that, they tune out,” Deloitte explained.

Why we care. For years marketers have been talking about “addressable TV.” It arrived in the form of OTT/CTV. Now the scale of traditional TV has arrived as well. This puts much more pressure or so-called linear TV as better targeting and attribution, and presumably better pricing and greater efficiency, draw more brand advertisers to CTV.

Increasing CTV audience sizes and available ad inventory got a lot of advertisers’ attention in Q2. But there still may be an early mover advantage left for those who jump in, rather than waiting until competition intensifies further to experiment with CTV.

This story first appeared on Search Engine Land. For more on search marketing and SEO, click here.

https://ift.tt/30jczM9

The post COVID is accelerating TV advertising’s transformation into an addressable medium appeared first on Marketing Land.

0 Comments